Special Report: The State of the Distributor Marketplace

While it might be easy to generalize the mergers and acquisitions activity currently consuming the pet distribution segment as the wholesale swallowing up of smaller enterprises by bigger companies backed with sizable resources, a more accurate assessment would show there is thought and nuance into these consolidations, particularly around the complementing of weaknesses and strengths. Such is the case with news in February that Pet Food Experts (PFX) acquired assets of Animal Supply Company (ASC). While the recent move renders PFX the largest pet specialty distributor in the US, in fact, the merging of resources to create a more unified entity serving the pet industry has long been the driver for M&A activity in pet distribution.

“We have seen significant consolidation with distributors throughout the past five years, now with fewer national players but still many regional distributors,” said Heather Govea, CEO of Carnivore Meal Company. “The distribution landscape, however, has strengthened as a whole. While consolidation has certainly impacted the landscape, we have seen distribution get smarter and more focused on the individualized markets they serve.”

“The last five years have been a bumpy ride for everyone in the industry,” said Jessica Farina-Morris, SVP of Marketing and Merchandising for Phillips Pet Food & Supplies. “The boom in pet ownership driven by Covid to the bounce back and stabilization, along with consolidation and shifting market dynamics have created a number of challenges, but those challenges also represent opportunities. One of the trends that seems to be here to stay is the growth of fresh and frozen food. This is an area Phillips is especially excited about as we can utilize our industry leading cold chain capabilities to safely link suppliers and retailers.”

Tim Batterson, former President and CEO of ASC and who in the near term will assist in the integration process between PFX and ASC, noted a year ago some of the changes in distribution. “Distributors are increasingly savvy in data analytics to gain insights into various market and industry trends,” he said. “Having a data-driven approach not only strengthens decision-making, it allows our team to be more empowered and consultative in their approach with retailers and brand partners, thus elevating the relationship.”

Perhaps as a bit of foreshadowing, Batterson also reflected last year, “A general theme you see in the pet industry is that retailers and brand partners are becoming larger through acquisitions. Distributors are essential partners to both brands and retailers and distributors will need to apply the same thought process to identify opportunities as the industry evolves.”

Pet Food Experts/Animal Supply

Pet Food Experts traces its history back to the 1930s with Herbert Baker’s tropical fish and aquarium supplies business based out of his home in Rumford, RI. Though the enterprise evolved through the rest of the 20th century to expand into pet retail—there are currently nine Rumford Pet stores in the Rhode Island and Massachusetts area—organically grow its wholesale arm and become the exclusive distributor servicing Southern New England in 1989, it entered the acquisition game in 2000 when it acquired Sharon’s Distributors, expanding its footprint through Northern Vermont and upstate New York.

The newest generation of the family jumped aboard in 1993 when Michael Baker took a managerial role in the company before becoming president.

Acquisitions snowballed in the 21st century. In 2005, PFX acquired OK Pet Supply and expanded into metro New York. In 2013, it acquired Zeus & Company in Illinois, adding 10 states to its footprint. In 2015, it acquired Northpoint Trading Company in Fife, WA, expanding into the Pacific Northwest. PFX’s territory grew again in 2018 when it acquired Monarch Pet Products, based in Denver, CO, from founders Jeff and Tracie Flora, which extended services to independent pet retailers in Colorado, New Mexico, Utah and Wyoming.

Speaking of PFX’s acquisitions in 2019, Baker said, “Our decision to expand outside of our southeastern New England roots, starting with Sharon’s have all been opportunistic,” he said. “In every case each of the targets have called us to sell their business to us, which demonstrates full circle it matters how you carry yourself, your reputation, your track record, and from a reference standpoint, we put ourselves out there when we had the financial ability to do so. With Sharon’s, our first one, it wasn’t like we ran an ad that said, ‘hey Pet Food Experts is looking to buy businesses outside of New England.’ You get to know people, and they sensed that as I took the business control from my dad and ultimately bought it from him after my parents got divorced, that we were a growth business and had a growth mentality. I remember in the case with Sharon’s we were talking to the owner, Michael, on a beach in Cancun at an Iam’s distributor sales meeting. We were standing ankle deep in the water and I can picture it like it was yesterday. He said, ‘I’m thinking of doing something differently, would you consider expanding into upstate New York? If so, maybe we should get together and talk about it.’ I couldn’t believe it—somebody was offering me to buy their business without me asking.”

And in 2021, it acquired United Pacific Pet, increasing service to retailers in California, Nevada, Arizona and Hawaii.

February’s acquisition of ASC now renders PFX the largest US pet specialty distributor serving more than 10,000 pet retail locations across the country, giving it access to ASC’s portfolio of brands including Diamond, KONG, Merrick and World’s Best Cat Litter, and its network of distribution centers spanning from the Pacific Northwest to the Northeast with facilities strategically located in Rhode Island, Pennsylvania, Illinois, Colorado, California and Washington state.

As part of this strategic move, former company head Baker returns to helm the company as President and CEO as Greg Cyr, who was appointed to the role in 2024, stepped down. At the time of Cyr’s appointment to CEO, it was announced that Baker would step into the role of vice chair of the board of directors.

“We are excited to integrate the strengths of ASC, particularly their battle-tested, hardworking and resilient team,” said Baker. “The opportunity to unite two legacies, each founded on a shared dedication to service excellence and strong relationships, has been nearly a decade in the making. By incorporating these strategic assets into our network, we are unlocking new opportunities to deliver unparalleled value to our retail and vendor partners.”

Baker traces his affiliation with ASC back to 2005, the year he acquired PFX from his parents. “I had already been in contact with ASC to seek their guidance on how to diversify our brand portfolio and better position the business for the future,” he said. “They were always generous with their time and open to discuss every topic, big or small, when we sought their advice. I can’t think of anything ASC was doing that PFX didn’t emulate in one way or another.”

According to Baker, by 2024, there had been upwards of nine attempts to combine the two businesses. “Despite ASC’s distressed financial condition, my partners and I felt compelled to move forward with our transaction and are extremely bullish about the future!”

Industry media reported in early February that ASC notified its employees via email of potential layoffs and facility closures even as dialogue was in progress regarding the PFX acquisition.

According to that employee email: “The Company has been facing a deterioration of business conditions and a liquidity crunch, which has resulted in an urgent need to conserve cash in order to continue as a going concern. In order to remain fully operational and prevent a mass layoff or business shutdown, the Company has been working with its investment banker and its secured lenders to obtain additional funding, including, but not limited to, pursuing several options for a purchase of assets by a qualified buyer.”

As part of the acquisition announcement, Tim Batterson, then CEO and President of ASC, said, “PFX has long been a distinguished leader in the industry, and this acquisition marks a significant step forward. Throughout my 11 years at ASC, Michael and I have shared a vision for this partnership, and I’m excited to collaborate with him and the entire team to ensure a smooth and seamless transition.”

ASC itself was founded by Randy Reber and John Shine in 1987 with 28 independent Purina Feed dealers, a warehouse in Auburn, WA and one semi-tractor trailer, according to then Senior Director of Vendor Sales and Marketing Sevy Maurer. As of October 2024, Maurer reported it was operating 17 distribution facilities across the US, housing more than 35,000 SKUs.

“Every acquisition comes with its own set of challenges,” Baker said in 2019. “As we tackle those challenges to the best of our ability, you come out the other end being that much stronger, and the next time the phone rings and somebody says, ‘Hey do you want to do business? Would you consider buying my business?’ It’s a lot easier to say ‘yes’ because we know what to do, and we know it’s not going to be easy, but we know what to do. Every time we’ve gone through those transition challenges we wouldn’t be in the situation that we’re in if our customers in every region we’ve expanded to, didn’t eventually love us for who we are and accept us for who we are. That’s rewarding when you have frustrated customers who, at first, either really liked the other family better or just don’t want things to change, which is human nature. Then eventually when they get to know us and see that they might have to call Rhode Island to place an order, and they might not get to talk to so-and-so who they came up with together and have known their whole career, and eventually again our business is fairly simple. We take orders and our job is to try to get that order delivered on time and at a fair value so we can keep doing what we’re doing. It’s been our focus to do that and help as many retailers as we can.”

Many are looking forward to a future with PFX characterized by a stronger, more comprehensive pet food distribution network, with a wider range of products and services available to manufacturers, retailers and pet owners.

“Pet Food Experts has been such an important partner for Austin and Kat, and having them at tradeshows is a fantastic opportunity to connect in-person and celebrate their ongoing impact on the independent pet space,” said Austin and Kat Founder Kat Donatello. “On top of that, seeing Michael Baker return as CEO is incredible—his leadership has always been instrumental in shaping the company’s success, and I can’t wait to see the energy he brings back to the team.”

Donatello elaborated, “It’s always great to see your distributor partners and get to have those one-on-one times with them. I feel really confident and positive with the relationship that we’ve developed with their team. Since 2018 we’ve been with them. It’s a long-term relationship, and we’ve seen the good, the bad and the ugly all together, but seeing them taking that leading charge in the marketplace, bringing Michael Baker back to the CEO role, we’re going to see some really incredible things happening from PFX this year. And their enthusiasm this year is contagious.”

Phillips Pet Food & Supplies

Phillips has also had a history with ASC. In February 2020, the two distributors announced a plan to merge. The move had been led by then CEOs Todd Shelton and Don McIntyre of Phillips and ASC respectively. As the pandemic took hold and ran its course through the year, they announced in August 2020 they were terminating the merger.

Shortly after in November 2020, the company announced a comprehensive refinancing, including more than $20 million of new investment capital from a group of existing investors along with an expanded revolving credit facility led by Wells Fargo Bank, and the appointment of current CEO Blaine Phillips as Chairman of the company.

Phillips had, in fact, served as CEO from 1981 to 2016. He was elected to CEO again at the start of 2021. “I was retired!” he told Pet Insight in 2021. “I rested up and refreshed my perspective. But, when you build something for your whole life, it’s a pretty quick study to get back into the swing of things. Last year [2020], I reinvested as an owner of Phillips and became Chairman of the Board. I came back as CEO in February, and honestly it was like I had never left. I’ve been refamiliarizing myself with our strengths and the unique challenges we face in today’s market, especially given the ongoing pandemic. While the industry has evolved in some ways, the core things you need to be effective are the same. My deep understanding of this industry, the ins and outs of all our operations, and the businesses of the customers and vendors we work with, gives me a strong foundation from which to approach this role with a renewed sense of passion and purpose in 2021.”

Since then, Phillips continues to grow its manufacturer partnerships. In the last year, the distributor entered into agreements and/or expansions with brands like Nulo, Natural Balance, Canidae and NutriSource. It announced at last year’s SUPERZOO it was the exclusive distributor for the Hagen Group. Phillips operates 11 distribution centers and two cross-dock facilities strategically located to optimize service across the continental US.

Last fall, the company announced a number of promotions on its executive leadership team. Nick Christensen, previously the COO, was promoted to President. And Jessica Farina-Morris was appointed Chief Sales and Marketing Officer.

Though these promotions bring a fresh perspective, Phillips seemingly read the writing on the wall by acknowledging in 2021 the overall distribution landscape will likely continue to skew toward consolidation. “To some extent, consolidation will likely continue,” he said. “We seek to have a broad product offering so we can be a one-stop shop for our customers across pet food and supplies, including the fresh and frozen food categories. To do so, it is critical for Phillips to have a national footprint, efficiency and scale to invest in the services and programs, like e-commerce capabilities, that help support our customers as well as our vendors.”

Central Pet Distribution

Central Garden & Pet was initially founded as Central Garden Supply, a distribution company in 1980 by Bill Brown, who remains Chairman of the Board. The company became Central Garden & Pet in 1992 and went public on the NASDAQ stock exchange in 1993. Since then, it has grown its product portfolio across both garden and pet, acquiring well-known brands including Nylabone, Kaytee Products, Farnam horse care products, and more recently TDBBS dog chews and treats in 2023.

Niko Lahanas is currently CEO of Central Garden & Pet. He came to this role in 2024 but originally joined Central in 2006, holding several financial roles before becoming CFO in 2017.

Glen Axelrod is SVP President, Dog & Cat. He is part of the original founding family of TFH, which Central acquired in 1997. Axelrod oversees TFH, Nylabone, Four Paws and IMS.

John Hanson has served as President, Pet Consumer Products since 2019, Prior to joining Central, Hanson held leadership roles at ConAgra, including president of its frozen foods division.

Central Pet Distribution’s six regional service areas cover nearly the entire country, with hubs in Hamilton, NJ (Northeast region), Tampa, FL (Southeast region), Dallas, TX (Midwest region), Santa Fe Springs, CA (Southwest region), Sacramento, CA (West-Central region) and Algona, WA (Northwest region).

ADMC

American Distribution and Manufacturing Company (ADMC) has had many names through its almost 100-year history. Founded as Newport Feed in 1936 by Tony Duclos, Sr., the enterprise began as a purveyor of livestock feed products on consignment from vendors. Duclos’ sons, Gary and Tony, Jr., took the next steps to evolve the family business into American AGCO, a wholesale distribution and manufacturing company.

By the mid 80s, the third generation of the Duclos family had continued expanding its service area and diversified its product portfolio to encompass segments including farm & fleet, pet, wild bird and wildlife products. In 2000, the family started an independently operated trucking company called American Logistics Services, and it also established ADMC as it is known today, with a diverse blend of products and services.

Presently, the fourth generation of the Duclos family is coming on board, and the company’s evolution continues into the realm of brand management, the opening of a second distribution center in Texas and the expansion of facilities and services across 18 states.

Jon Duclos is currently ADMC Owner and President. Learning the business since the tender age of 10, Duclos gained experience across all facets of the family business, from warehouse to manufacturing, to sales and marketing and purchasing to operations. He attended the University of Wisconsin-River Falls where he ran the corporate research farm where feed trials were performed for the company’s brand of livestock feeds.

Currently, Duclos’ daughter Bethany is business development representative and son-in-law Matt Pawlikowski is corporate IT manager. Daughter Maddie is a digital marketing coordinator and son Jack is an analyst and executive assistant to the president.

ADMC’s overall service area is supported by 10 locations delivering to 18 states in the central corridor of the US, including Colorado, North and South Dakota, Minnesota, Michigan, Wisconsin, Iowa, Nebraska, Illinois, Indiana, Kansas, Missouri, Oklahoma, Arkansas, Louisiana and Texas.

Southeast Pet

The road to Southeast Pet began in Long Beach, CA where Founder Greg Judge helped manage three family fish stores in the city. In 1965, Greg brought those SoCal roots to Georgia where he and his uncle co-founded Long Beach Fisheries. A decade later, in 1975, he and his wife Holly opened Southeast Aquatics in Atlanta, which evolved into Southeast Pet two years later.

As the Judges worked to build the business, they also ensured that employees were equal participants. In 2015 they sold 100 percent of the company to the employees as an ESOP (Employee Stock Ownership Plan).

Today, Greg Judge serves as Southeast Pet’s CEO while son Ryan Judge, who joined in 2000, is president. Southeast Pet operates two distribution centers out of Georgia and Florida, amounting to more than 200,000 square feet of warehouse space. The distributor services Alabama, Florida, Georgia, Tennessee, North Carolina and South Carolina as well as parts of the Caribbean.

Pet Palette

Pet Palette is the new kid on the block, having been established in 2008 by veterinarian Bruce Herwald. Based in Sykesville, MD, Pet Palette specializes in hard goods like toys, along with treats and chews, and currently serves retailers across the lower 48 states.

According to its website, “We strive to be the only distribution partner you’ll ever need. From holiday and novelty items to best-in-class toys and puzzles, freeze-dried consumables, pet accessories, and more—we hand pick every item with retailers like you in mind.”

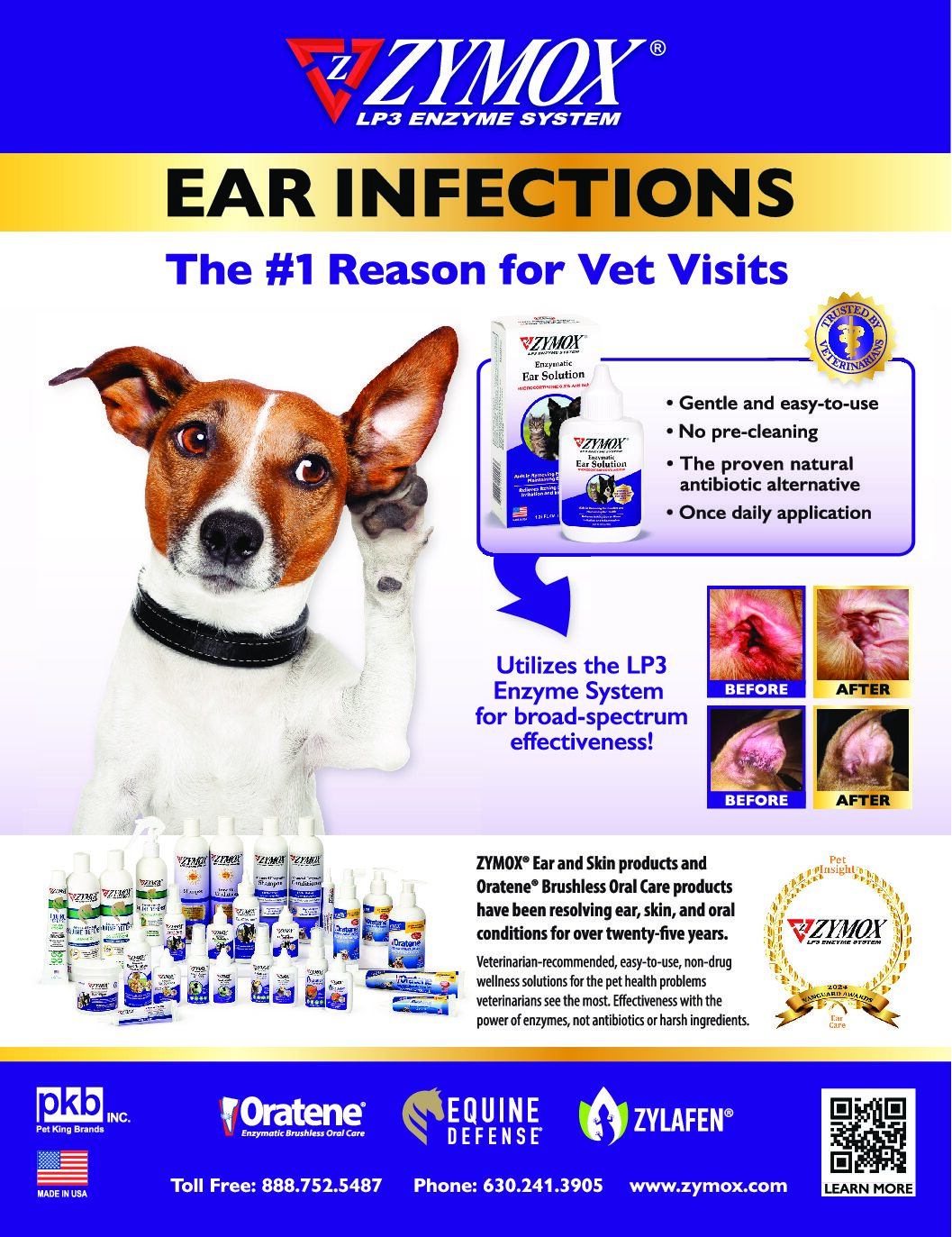

The distributor has been working at a furious clip to engage in partnerships with a variety of well-known brands including Pet King Brands, ThoozyPet, BAYDOG, KONG and PetShop by Fringe Studio. This past October, it entered into the professional grooming space, launching several top grooming brands including Artero, Andis and Professional Pet Products.

Since its founding, Pet Palette had been led by Herwald and a number of seasoned veterans including Mike Dagne who is now president of Huxley & Kent, and Ron Metzger, who in 2022 oversaw its rebranding to Pet Palette Distribution.

Leadership shifted again in July 2024 when the company’s business assets were acquired by industry veteran Chris Miller and Canopy Capital Partners, a Tampa-based private equity firm. Miller previously led Boss Pet Product, in acquiring and turning around PetEdge, a leading professional pet grooming supplier and consumer pet products e-commerce company.

“Pet Palette is renowned for its expertly curated assortment of quality pet product brands, outstanding customer service, and impeccable operations,” said Miller. “We are thrilled to partner with our valued customers and the veteran management team to build on the strong foundation that has been established. Our goal is to innovate new products, expand business channels and meet the evolving needs of our diverse customer base, including expanding into complementary product verticals such as pet grooming.”

“This is a fantastic opportunity for our amazing customers, employees and associates,” said Herwald, Founder of Pet Palette. “With these new resources, we can accomplish many of the initiatives we have always envisioned and continue to serve our customers better than ever.”

“We’ve been searching for the right business and partner to kick off our investment thesis in the pet space, and we believe Pet Palette, under Chris Miller’s leadership, is the perfect fit,” said Beckett Brandewie, Principal at Canopy Capital Partners. “We are excited to support the business and Chris’ vision for creating an ecosystem of the highest quality pet products and brands aligned with customers’ wide-ranging needs.”

Veterinary Services Inc. (VSI)

Veterinarians Willis D. Woodward and Donald W. Rosenberg, along with Frank G. Sweetman, a former sales representative for Van Waters and Rogers—now known as Univar Solutions—established VSI in 1960 primarily as a poultry distributor. John E. Pugliese, who had been working for Merck, later joined the partnership in 1962.

In 2023, VSI announced it had acquired MWI Animal Health‘s poultry business. VSI obtained three poultry locations, enabling VSI to service all of the poultry operations east of the Rockies.

President and CEO Brad Gohr also announced on LinkedIn in that last year that VSI had additionally acquired Armor Animal Health. “We are grateful for the opportunity to welcome the Armor Team to the VSI Family,” he wrote. “All in an effort to provide continuous industry leading service across the country to our customers and best in class representation for our vendor partners.”

Today, VSI services customers across sectors including the beef, dairy and poultry business as well as feed supply and pet stores. Its livestock and dealer warehouses located in Albany, OR; Visalia, CA—just livestock—and Riverside, CA serve hundreds of dairies and retail stores spanning the West Coast. Poultry warehouses in additional locations in Fresno, CA; Nacogdoches, TX; Springdale, AR; Gainesville, GA, Beaver Dam, WI and Cortland, NY serve poultry operators across the country.

AFCO

AFCO Distribution & Milling came into being more than 10 years ago with the merging of Spokane-WA-based Aslin-Finch Co. and Skagit Farmers Supply in Burlington, WA. According to history provided by the Spokane Journal of Business, Aslin-Finch began in Spokane in 1937 and had evolved into several retail stores and a wholesale network when Skagit acquired it in 2013.

Presently, their combined retail business now operates under the Country Store name and has locations in Washington and Montana. AFCO now manufactures its private-label brand of farm feed named Aslin-Finch and sells it exclusively at Country Store locations.

Skagit Farmers Supply also encompasses an agronomy center, which provides fertilizer and chemical support for farmers and an energy division that sells bulk fuels and propane.

Meanwhile, AFCO operates as the manufacturing and distribution division of Skagit Farmers Supply, shipping more than 7,000 wholesale products including animal feeds, wildlife products, pet food and supplies along with assorted equipment from its Spokane Valley and Burlington, WA warehouses daily.

Lloyd Campbell, VP of Wholesale Operations, told local media last year that pet food and supplies currently make up about 70 percent of AFCO’s business. Having been with the company since its Aslin-Finch days, he told the publication, “To see where it has come from to where it is today is a lot of fun.”

The company covers a service area that includes Washington, Oregon, Idaho, Montana, Wyoming, Utah, Nevada and Alaska.

Bradley Caldwell

Founder Jim Bradley established Bradley Caldwell (BCI) in 1994 when he merged his company, New Holland Supply, with Caldwell Supply. BCI remains a full-line distributor supporting independent retailers with a more than 23,000 products in four categories: pet, equine and livestock, lawn and garden and farm and home. Having worked in distribution for more almost five decades, Bradley passed away in 2022.

While the company is based in Hazelton, PA, its service area covers the Northeast and extends as far west as Michigan and as far south as Virginia.

Fauna Foods

Family-owned and operated Fauna Foods was established in 1976 by current president Ira Slovin and is a wholesale distributor of a wide range of products including natural, organic, frozen and holistic pet foods, treats, grooming products, litters and various pet supplies. Recent brands added to its portfolio include Montana Dog Food and A Pup Above.

Slovin has said in past media profiles he started Fauna Foods at a time when pet food was largely distributed via local supermarkets, mostly mass produced, though there were smaller, more localized manufacturers as well. Through these decades, Fauna Foods helped to pioneer a higher standard for pet food and products as the pet industry moved away from largely farm and feed stores and toward pet specialty stores.

Today, Slovin works alongside his son Sam Slovin, who is the Director of Sales. They are supported by Michael Silver, VP of Sales and Marketing.

Fauna Foods has earned a ‘superior’ rating from the independent inspection program AIB International, which in part sets standards for food distributor centers that cover food safety, pest control and operational hygiene.

The distributor services assorted pet stores, veterinarian offices, breeders, guide dog associations, police canine divisions, groomers, kennels and animal shelters in New York, New Jersey and Connecticut.

Frontier Distributing

Like several other family-owned distributors, Frontier Distributing is rooted in the farm and feed business dating back to the 30s, though its current iteration technically was established in 1986 by Mark Smith and Geoff Savage as Purina Service Center, conceived of to distribute the pet specialty only Pro Plan brand of dog and cat food.

Smith’s family’s history as a farm and feed distributor—they became Ralston Purina Dealers in 1964 and took over operations at the Rochester Grain Elevator around the same time—and Savage’s family’s history in wholesale distribution of lawn and garden and landscape supplies, brought the partners together.

In the 80s, Smith and Savage experimented with adding lawn and garden products to their Frontier Distributing services but by the 90s, the company was fully a distributor of pet foods and products.

Since then, Savage left the business in the 2000s, and in 2006, Nestle Purina dealt a blow by ending its distribution partnership with Frontier. “Half of the employees were laid off and the remaining staff retooled, reenergized, reinvented and reemerged to become known as the distributor of natural and holistic pet foods in the area that Frontier served. By grace, Frontier emerged as a stronger and more diversified company,” according to company history.

Today, Smith remains President and Owner of Frontier Distributing. His son Jacob Smith is General Manager.

Frontier Distributing currently serves more than 110 vendors with more than 6,000 products across six states: Michigan, Indiana, Ohio, Pennsylvania, Kentucky and West Virginia.

Independent Pet Supply

Keya and Neda Khorami established Independent Pet Supply (IPS) in 1994 when the couple moved from Northern California to Washington state. They also took with them the experience and insights they gained from operating a pet food and supply store, along with a proposition from one of their manufacturer partners from their retail days to distribute their line.

Neda Khorami recounted in a media profile: “This collaboration marked the beginning of our expansion into distribution, fueled by our shared commitment to excellence and innovation.”

The couple established IPS to be a vital resource and partner for independent pet retailers who were facing an increasingly crowded marketplace. “The pet industry is recognizing what we’ve always known: independent pet stores are irreplaceable. They provide personalized service, expert advice and build real connections with their customers—things that big national chains can’t replicate,” said the company.

IPS has grown its distribution services across state lines through the Pacific Northwest to include Oregon, Idaho, Montana as well as Alaska and Hawaii. In 2023, IPS announced the launch of a new division Independent Pet Supply South, serving the Southern California market. This year, IPS is celebrating its 30th anniversary.

The Big Picture

Whatever the pet distribution landscape might look like in the near future, the needs of both retailers and brand partners are not going to diminish.

“Distributors play a critical role in the pet industry,” said Farina-Morris with Phillips. “With more brands and products available than ever before, distributors help retailers access a much broader portfolio than they would be able if they had to manage a direct relationship with each supplier. Distributors also play a crucial role to the suppliers of introducing products to the thousands of retail storefronts across the country.”

Phillips has and will continue to focus on the independent pet retailer, she said. “This customer is the lifeblood of Phillips, and we will remain committed to providing the absolute best service possible to them as we fulfill our mission to help them serve the pet owners and communities that rely on them,” said Farina-Morris.

“The industry has experienced significant shifts, especially with the rise of e-commerce and direct-to-consumer models,” said Baker. “At the same time, there’s been a growing demand for fresh and frozen pet foods, requiring distributors to build out specialized cold-chain capabilities. The companies that have been able to adapt and innovate are the ones continuing to thrive.”

Backed by a solid foundation of industry and technological expertise, PFX stands with those ready to look to the future. “Our continued success comes down to our people, our partnerships and our unwavering commitment to doing business the right way,” Baker said. “We prioritize trust, integrity and collaboration in everything we do. Our ability to adapt and innovate, while staying true to our core values, is what sets us apart.”

Regional or national, as long as distributors remain adaptable to change and stay focused on relationship building and helping partners understand they have someone in their corner, rooting for their success, there will be prospective partners waiting to work with them.

Inside

Special Report: The State of the Distributor Marketplace

Q&A Interview: Michael Baker, President and CEO, Pet Food Experts

Special Report: Private Label in Pet

Global Pet Expo Takeaways: Roundtable

Global Pet Expo Takeaways: Exotics Merchandising

Global Pet Expo Takeaways: Grooming

Global Pet Expo Takeaways: Litter